This content is for informational and entertainment purposes only, not financial advice. The authors are not professional traders. Trading involves risk and is not suitable for all investors. Decisions should be made with consideration from a financial advisor. This article may contain affiliate links. For full details, see our Affiliate Disclosure and Full Disclaimer.

Table of Contents

I: Introduction to Breakout Trading

A: What is Breakout Trading?

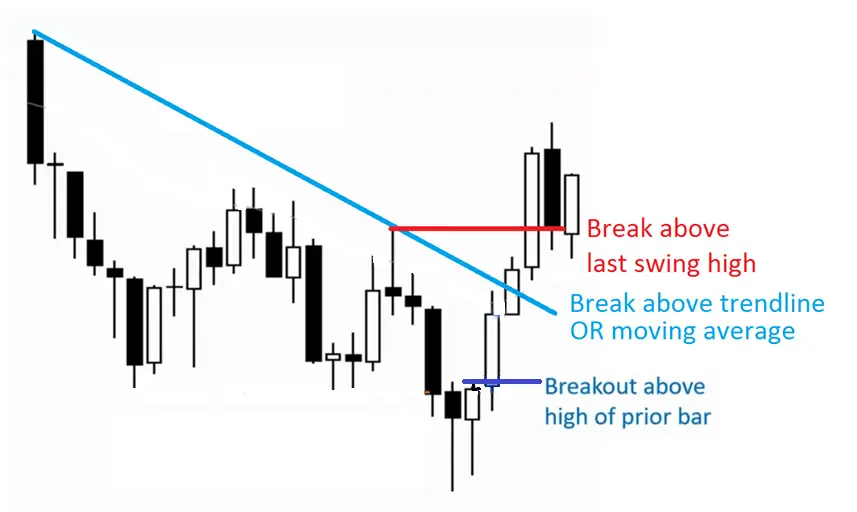

Breakout trading is a dynamic and widely used strategy among traders, aiming to capitalize on significant price movements. This approach involves identifying key moments when a stock’s price surpasses a defined boundary, which is typically a level of support or resistance. The trading strategy hinges on the concept that such breakouts, especially when accompanied by high trading volume, signal a potential for substantial price movement. Traders who utilize breakout trading effectively are those who can discern these pivotal points and act swiftly, riding the momentum as the stock moves beyond its previous confines.

B: The Psychology Behind Breakout Trading

Breakout trading is deeply rooted in market psychology, underpinning the collective behavior of market participants. It’s more than just observing price charts; it involves a keen understanding of how traders react to certain market conditions. When a stock price surpasses a long-standing support or resistance level, it often triggers a psychological response among traders, contributing to the momentum. This strategy requires not only technical analysis skills but also an intuitive sense of market sentiment, allowing traders to anticipate movements before they become apparent to the wider market.

C: Importance of Volume and Catalysts

In breakout trading, volume plays a pivotal role as a validating factor. A breakout accompanied by high trading volume is generally considered more reliable, suggesting a strong market consensus behind the price movement. Moreover, certain catalysts, such as earnings reports, significant company announcements, or macroeconomic events, can serve as the spark that ignites these breakout moments. These events can profoundly influence investor sentiment, propelling stock prices into new territories. Understanding the interplay between volume and market catalysts is crucial for traders to identify genuine breakouts and avoid false signals.

II: Key Strategies and Tactics in Breakout Trading

A: Technical Analysis and Pattern Recognition

In the realm of breakout trading, technical analysis and pattern recognition form the cornerstone of successful strategies. Renowned traders, including Linda Bradford Raschke, emphasize the significance of identifying and interpreting chart patterns such as triangles, flags, and wedges. These patterns often precede major price movements, making them invaluable for predicting breakout points. Alongside these, the use of technical indicators like the Relative Strength Index (RSI), Moving Averages, and the Average True Range (ATR) is crucial. These tools help traders gauge market momentum, trend strength, and potential volatility, enabling more informed decisions on when to enter or exit trades.

B: Risk Management

Risk management is a critical component in breakout trading, fundamental to preserving capital and sustaining long-term profitability. One of the most effective risk management tools is the use of stop-loss orders. These orders help traders limit potential losses by automatically exiting a trade at a predetermined price level. Implementing stop-loss orders effectively can protect traders from sudden market reversals that are common in breakout scenarios. Additionally, traders should also consider position sizing and diversification as part of their risk management strategy, ensuring that they do not overexpose themselves to any single trade or market movement.

C: The Role of Emotional Discipline

Emotional discipline is a key factor that often separates successful traders from the rest. In the fast-paced environment of breakout trading, maintaining emotional control and flexibility is vital. Emotional discipline involves the ability to stick to a trading plan as well as trading psychology without being swayed by fear, greed, or other emotional responses to market fluctuations. This discipline ensures that decisions are based on logical analysis and predetermined strategies rather than impulsive reactions. Additionally, flexibility is important in adapting to changing market conditions, allowing traders to pivot their strategies when necessary while still maintaining control over their emotions.

III: Practical Tips for Successful Breakout Trading

A: Waiting for High Volume

One of the most reliable indicators of a potential breakout is a significant increase in trading volume. A surge in volume often suggests heightened interest and activity in a stock, which can precede major price movements. Traders should closely monitor volume patterns, especially during periods surrounding major news releases or market events, as these can be catalysts for breakouts. High volume provides validation for a breakout, indicating a stronger commitment from market participants and a higher likelihood of the trend’s continuation. Therefore, waiting for this surge in volume before making a move can increase the chances of entering a profitable trade.

B: Building a Watchlist

Creating and maintaining a watchlist is an essential practice for successful breakout trading. This involves identifying stocks that exhibit potential for breakout and closely monitoring their performance. Utilizing scanners and other trading tools can significantly aid in this process, allowing traders to filter and identify stocks based on specific criteria such as price patterns, volume changes, and technical indicators. Regularly updating the watchlist and keeping abreast of market developments related to these stocks can provide early signals for breakout opportunities, enabling timely and strategic trading decisions.

C: Trading with the Trend

For breakout traders, particularly those who are new to the strategy, it is advisable to align trades with the overall market trend. Trading with the trend means capitalizing on breakouts that move in the same direction as the prevailing market trend, thereby increasing the probability of a successful trade. This approach reduces the risk of going against market momentum and can be more manageable, especially for beginners. It involves analyzing longer-term trends to understand the general market direction and then looking for breakout opportunities that align with this direction. Trading with the trend can provide a more structured framework for decision-making and help in avoiding trades that go against market sentiment.

IV: Common Breakout Trading Mistakes to Avoid

A: Avoiding Late Entries

Timing is a critical factor in breakout trading. One common mistake is entering a trade too late, after a significant portion of the breakout movement has already occurred. Late entries not only reduce the potential profit margin but also increase the risk, as the price may be closer to a reversal point. To maximize the effectiveness of breakout trading, it is crucial to identify potential breakouts early and act swiftly. This requires continuous monitoring of the markets, understanding of the factors that lead to breakouts, and readiness to execute trades as soon as a breakout is confirmed.

B: Not Adhering to a Trading Plan

Successful trading relies heavily on discipline and adherence to a well-thought-out trading plan. A common mistake among traders is deviating from or not having a solid trading plan. This plan should include clear criteria for entering and exiting trades, risk management strategies, and specific trading goals. Without a structured plan, traders are more susceptible to emotional decision-making and impulsive actions, which can lead to inconsistent trading and potential losses. Consistently following a trading plan helps in maintaining focus, making rational decisions, and managing the psychological aspects of trading.

C: Ignoring Market Indicators

Ignoring key market indicators is another mistake that can lead to unsuccessful trades. Support and resistance levels, chart patterns, and volume are crucial indicators that provide insights into market behavior and potential breakout points. Neglecting these indicators can result in misjudging breakout signals, leading to premature or misguided trades. Successful breakout traders pay close attention to these indicators, using them to assess the strength and validity of a potential breakout. By effectively incorporating these indicators into their analysis, traders can make more informed decisions and improve their chances of executing profitable trades.

V: Advanced Techniques in Breakout Trading

A: Intraday Trading Breakout Strategy

Intraday breakout trading is a high-paced strategy that involves entering and exiting positions within the same trading day. This approach demands constant vigilance and the ability to react quickly to market changes. Successful intraday breakout traders closely monitor technical indicators, including real-time price movements, volume, and news feeds, to identify potential breakout points as they develop. A well-structured trading plan for intraday breakout trading should include precise entry and exit points, risk management rules, and contingency plans for unexpected market movements. The key to excelling in this strategy is the ability to make rapid, well-informed decisions and to remain disciplined in the face of market volatility.

B: Swing Trading Breakout Strategy

Swing trading breakout strategy extends beyond the day-to-day market fluctuations, focusing on capturing price movements that occur over a period ranging from several days to weeks. This method requires a deeper analysis of the stock’s chart history and an understanding of broader trend directions. Swing traders often utilize a combination of technical analysis and fundamental analysis to identify potential breakout opportunities. They look for patterns or trends that indicate a stock is building momentum for a breakout. Patience is vital in swing trading, as positions are held longer to capitalize on anticipated price movements. This strategy suits traders who prefer a more measured approach, balancing the need for comprehensive analysis with the anticipation of significant price changes.

C: Forex Breakout Strategy

Breakout trading in the forex market presents unique challenges and opportunities due to its 24-hour operation and the influence of global economic factors. Like other markets, breakouts in forex are characterized by a currency pair moving beyond a defined support or resistance level, often driven by macroeconomic news, geopolitical events, or changes in monetary policy. Traders utilizing a forex breakout strategy must conduct thorough research to understand the factors that influence currency movements. They should also be aware of the times when the market is most active, as breakouts are more likely during periods of high liquidity. A successful forex breakout strategy incorporates a sound understanding of forex market dynamics, including the impact of global events and the interplay between different currency pairs.

VI: Conclusion

Breakout trading, when meticulously executed, stands as a potent strategy in the repertoire of a seasoned trader. Its effectiveness is markedly enhanced when supported by substantial trading volume and underpinned by a solid catalyst, signifying a genuine shift in market dynamics. The essence of successful breakout trading lies in a harmonious blend of astute technical analysis, rigorous risk management, and a deep understanding of market psychology. Mastery in this domain is not just about charting or recognizing patterns; it’s about comprehending the underlying market sentiments that drive price movements. A trader adept in breakout trading not only follows the trends but also anticipates them, capitalizing on opportunities as they emerge. As such, breakout trading, with its multifaceted approach, offers a powerful and dynamic means to navigate and profit in the ever-evolving landscape of financial markets.